Understanding Personal Finance: A Comprehensive Guide

- By admin --

- Sunday, 12 Mar, 2023

Personal finance refers to the management of an individual's financial resources, including income, expenses, savings, investments, and debt. It involves making informed decisions about how to allocate and use one's financial resources to achieve personal financial goals, such as saving for retirement, buying a home, paying off debt, or funding education.

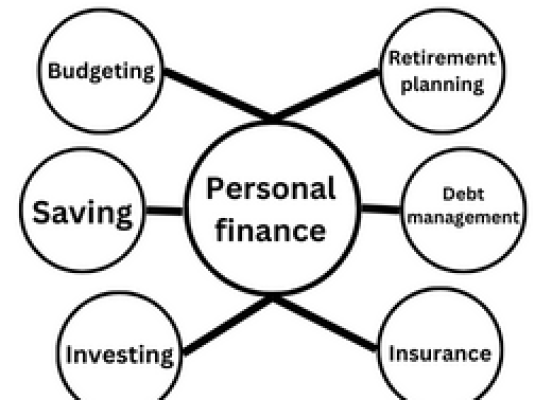

Personal finance includes a wide range of activities and strategies, such as budgeting, saving, investing, retirement planning, insurance, and tax planning. It also involves developing a financial plan that takes into account one's income, expenses, and financial goals, and making adjustments as needed to ensure that one's financial resources are being used effectively.

Overall, personal finance is about taking control of one's financial future by making informed decisions, managing risk, and planning for both short-term and long-term financial goals.

Personal finance is a crucial aspect of overall financial wellbeing, as it enables individuals to make the most of their financial resources, build wealth, and achieve their financial goals. It involves a combination of financial knowledge, skills, and behavior, as well as access to financial products and services that can help individuals manage their money effectively.

Some key areas of personal finance include:

-

Budgeting: Creating and sticking to a budget can help individuals manage their income and expenses, and make informed decisions about where to allocate their money.

-

Saving: Setting aside money regularly can help individuals build an emergency fund, save for future expenses, and achieve long-term financial goals.

-

Investing: Investing can help individuals build wealth over time, but it requires knowledge and understanding of different investment options and risks.

-

Retirement planning: Planning for retirement is essential to ensure that individuals have enough income to support themselves in their later years.

-

Debt management: Managing debt can help individuals avoid high interest rates and fees, and work towards paying off debt over time.

-

Insurance: Having insurance can provide financial protection against unexpected events, such as illness, injury, or damage to property.

Overall, personal finance is about taking a proactive approach to managing one's financial resources, making informed decisions, and planning for both short-term and long-term financial goals. By developing good financial habits and seeking out resources and support when needed, individuals can achieve greater financial security and independence.